|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

|

|

|

FHA Loan Maryland: A Comprehensive Guide for HomebuyersIf you're considering buying a home in Maryland, an FHA loan might be an ideal option for you. These loans are popular among first-time homebuyers due to their relatively lenient qualification requirements and lower down payment options. What is an FHA Loan?The Federal Housing Administration (FHA) loan is a government-backed mortgage designed to help more people become homeowners. It is particularly popular among first-time buyers and those with less-than-perfect credit scores. Benefits of an FHA Loan

It's important to stay updated on loan interest rates today to ensure you're getting the best deal possible. Qualifying for an FHA Loan in MarylandMeeting the criteria for an FHA loan in Maryland involves several key factors. Credit Score RequirementsGenerally, a minimum credit score of 580 is needed for a 3.5% down payment. However, scores as low as 500 may qualify with a higher down payment. Income and Employment VerificationApplicants must demonstrate steady employment and a reliable income stream, typically over the past two years. Types of FHA Loans AvailableBesides the standard FHA loan, there are several other types tailored to different needs.

Frequently Asked Questions

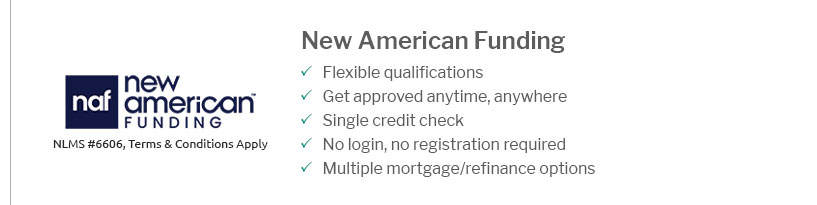

Understanding the ins and outs of FHA loans in Maryland can help you make informed decisions on your path to homeownership. https://www.newamericanfunding.com/loan-types/fha-loan/state/maryland/

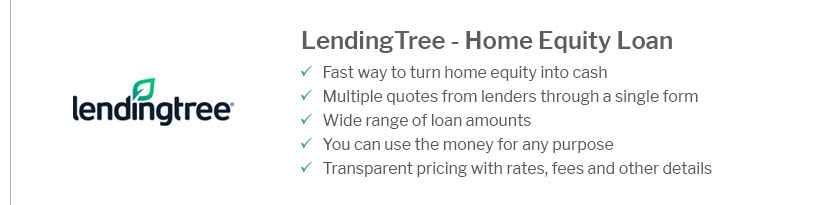

To qualify for an FHA loan in Maryland, you must meet the above requirements. You must have a credit score of at least 500. Your DTI must be less than 57%. You ... https://www.lendingtree.com/home/fha/fha-loan-limits-in-maryland/

The FHA loan limit floor is 65% of the national conforming loan limit, currently $806,500. The floor limit applies to areas where 115% of the median home ... https://griffinfunding.com/maryland-mortgage-lender/fha-loans/

Griffin Funding offers top-tier FHA loans in Maryland that are tailored for borrowers to make their homeownership dreams reality.

|

|---|